Pure Oil Refinery At Cabin Creek

The

Pure Oil Company is a firm with Ohio roots, having started out,

in 1920 as the “Ohio Cities Gas Company, the natural gas utility for

Columbus, Springfield and Dayton.” However, crude oil was

discovered as a result of drilling for natural gas, and the company

found itself in the oil business.

The Pure Oil Company was

sold to what is now Union Oil Company of California in 1965. The Pure

Oil name returned in 1993 as a cooperative (based in Rock Hill, South

Carolina since 2008) which has grown to supply 350 members in 10

Southern states. Pure was organized by independent interests to

counter to the dominance of Standard Oil Company in the Pennsylvania

oil fields, and was the second oil company (after Standard) in the

region.

|

Cabin Creek Crude was considered the finest oil in the world at that time. It actually came out of the ground looking already refined.

|

|

The

Pure Oil Company was a union of the old Pure Oil Company of New Jersey

and the Ohio Cities Gas Company of Ohio. The old Pure Oil Company was

the means of overcoming by united effort the difficulties of small

independent producers and refiners in the early days of the oil

industry. The Ohio Cities Gas Company was the vehicle which hauled an Ohio gas company from the brink of failure.

It

could truthfully be said that the exhaustion of natural gas supplies

for Columbus, Ohio, back in 1911 and 1912, which developed into a grave

situation for the stockholders of the Columbus Gas & Fuel Company,

then responsible for supplies of this fuel to about 41,000 consumers of

that community, was an epochal event because of its influence upon the

future of the Pure Oil Company.

Beginning in the winter

of 1910 and 1911, this gas supply fell off below the needs of the

company's consumers. Intensive drilling and prospecting failed to

replace the lost volume. There was some oil production found, but

officials of the company apparently did not favor the prospect of

having a gas concern develop an oil business. They

sought to acquire gas supplies by purchase contract with the Ohio Fuel

Supply Company, having a vast production in West Virginia and

practically the only visible source of supply for Columbus.

Growing

dissatisfaction with the affairs of the company reached a climax at the

annual meeting in 1913 when a reorganization was demanded. It was at

this time that Peman G. Dawes was asked to take over the affairs of the

company. He was at that time 43 years of age, with an extraordinary

record of achievement, both as an engineer and an operator of public

utilities and gas and oil properties. As an engineer he had built

tunnels, streets and highways, a railroad in Mexico and one of his

greatest engineering achievements was the erection of the great

cantilever bridge over the Ohio River at Marietta, Ohio.

Mr.

Dawes' genius for organization and business building had an immediate

effect upon the affairs of the Columbus Gas & Fuel Company. He

renewed negotiations with the Ohio Fuel Supply Company but at the same

time very quietly began leasing lands in Boone and Kanawha counties of

West Virginia, believed to have great gas producing possibilities.

These leasing operations were carried on through a number of men, each

working independently. When the aggregate of their leaseholds was more

than 250,000 acres, the Boone Royalty Company was formed in West

Virginia in October, 1913, to hold these properties. A campaign of

drilling was started almost immediately to develop natural gas

production, and plans were made to build a pipe line from Columbus to

carry the gas to the consumers of the Columbus Gas & Fuel Company.

With

plans for building a pipe line to Columbus and the bringing of West

Virginia natural gas in volume, Mr. Dawes and F. S. Heath, who became

associated with him as secretary and treasurer of the company, proposed

to supply other Ohio cities.

They

completed a well on a 12,000-acre lease in Kanawha County, West

Virginia, which flowed 215 barrels of oil the first twenty-four hours

after being drilled into the Berea sand.

This

was the discovery well of the now famous Cabin Creek field, getting its

name from a little creek that wound its way through the mountains of

this region. It was from this event that Ohio Cities Gas Company

started its phenomenal success in the oil industry. The company had

250,000 acres of leaseholds in this region, running northeast and

southwest through Boone and Kanawha counties. The location of the

discovery well was near the center of the northeast group of holdings. No such crude oil had ever before been found. It

was a clear, bright amber color of 47 degrees gravity, and samples

taken right at the well looked like a high grade product from a

refinery. It was hard to believe that these bottled samples were really

crude and not refined oil. It was found to have a refining

content of 15 per cent, aviation gasoline, 23 per cent motor gasoline

24 per cent kerosene, 6 per cent fuel and gas oil, 14 per cent wax

distillate, 14 per cent 600 cylinder stock and 4 per cent refining

loss.

Nature set up the most formidable barriers against development of the Cabin Creek region. It

is rugged and broken with steep mountains, narrow valleys and ravines,

thickly covered with timber and undergrowth. In the beginning it

presented an almost impossible prospect from an engineering standpoint.

Unusual resourcefulness, however, has converted many of these obstacles

into advantage. Practically all the timer necessary for construction

work was cut over the property. The building of roads for

transportation of materials and supplies by wagon or truck presented

almost insurmountable difficulties; so the company laid a narrow

gage railroad over the property, extending it as development proceeded

until at present it is composed of twenty-five miles of track and the

grades have been largely used in operating partly by gravity.

For

six years now this remarkable oil field has yielded 2,500 to 3,400

barrels daily, depending upon the needs of the company for this high

grade oil. It would be comparatively easy by intensive drilling to

increase the output of the field to several times its present rate of

about 3,000 barrels production. Owning the area yielding this high

grade oil in its entirety, however, the company has never found it

necessary to put its development work under pressure.

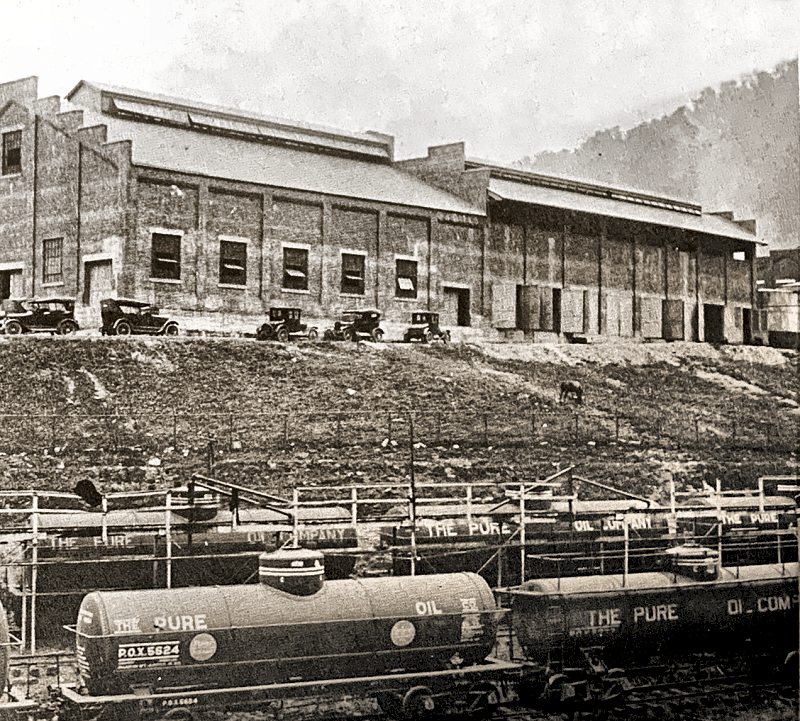

During 1916 the company built a complete refinery adjacent to these

producing properties and operations have been consistently maintained

to conform to the refinery requirements and the price situation. There

never has been a barrel of oil produced in this field that did not

command a premium price over the Pennsylvania grade market.

During the period when Pennsylvania crude had a market of $6.10 a

barrel, Cabin Creek crude commanded a price of $6.87. At the present

time, with the Pennsylvania price at $3.50, the market for Cabin Creek

crude is $4.

With

215 producing wells in this field at the present time, some idea of the

earning possibilities is indicated by individual well results. As an

instance, well No. 88 was completed in June, 1917, with an initial

production of 417 barrels daily, at a cost of $11,189. Its production

to date aggregates 138,000 barrels, which yields a gross income of

$672,000, and, after deducting drilling costs and operating expenses

from the beginning, shows a net income balance of $650,891. This well

is still flowing thirty barrels a day of the premium crude and the well

known staying qualities of the eastern producing sands suggest that

this well will eventually yield a net revenue to the company of

approximately $1,000,000. A number of other wells in this field are

making even greater producing and earning records, but not being as old

as No. 88, the figures of this well would appear more conservative for

illustration.

THIS NEXT PARAGRAPH IS VERY IMPORTANT

At

the present time the physical properties of the Pure Oil Company

include more than 5,000 producing oil wells located in the principal

fields of this country; this does not include wells of the Humphrey Oil

Company in which the Pure Oil Company has an important interest,

and which company was the discoverer and dominant operator in the new

Mexia, Texas field. In addition to its interest in the Humphreys Oil

Company, Pure Oil has 50 per cent interest in the Humphreys-Pure Oil

Pipe Line Company, having a complete pipe line system from Mexia, Texas

to the Gulf Coast, with a terminal at Smith's Bluff, below Beaumont,

and 50 per cent interest in the Humphreys-Pure Oil Refineries

Corporation, which has tank farms and vast storage facilities at Mexia

and at Smith's Bluff, Texas. Pure Oil Company's crude oil production at

the present time, including that of its collateral interests,

aggregates an amount in excess of 30,000 barrels a day. The company has

3,800 miles of pipe lines connecting more than 10,000 producing oil

wells.

Humphrey's was a Sissonville boy. See more HERE

|

Pure Oil Station At 5 Corners In Charleston WV

See more on this photo HERE

A

Pure Oil Gas Station, built in 1933 and located at Saratoga Springs,

New York, was listed on the National Register of Historic Places in

1978. Others stations like this have also been added. Charleston

has one of the best examples of this architecture and yet we havent

even thought about saving it.

Across the United States, gas

stations are slowly being rediscovered for their historic significance.

They have even been included on statewide endangered property lists.

Once spurned as out of place incursions or eyesores, historic stations

are increasingly appreciated for their contribution to the character of

a neighborhood, and the way they are easily adapted for new uses.

|

Back to Index

|